The Government of India has made it compulsory to attach a 10-digit PAN card with a 12-digit Aadhar card. Although the last date for this was June 30, 2023. It is compulsory for several services such as filing income tax returns (ITR), claiming tax refunds, opening a bank account, purchase of mutual funds units, Issue of debit/credit cards, conducting bank transactions exceeding Rs.10,000, and a lot more.

The e-filing portal page of Incometax.gov.in says, “For existing PAN holders, who were allotted PAN on or before 01-07-2017 it is mandatory to link PAN with Aadhaar. The Link Aadhaar service is available to individual taxpayers (both registered and unregistered on the e-Filing Portal). If you do not link your PAN with the Aadhaar till 30th June 2023, your PAN will become inoperative. However, people who fall under the exempted category will not be subject to the effects of PAN becoming inoperative.”

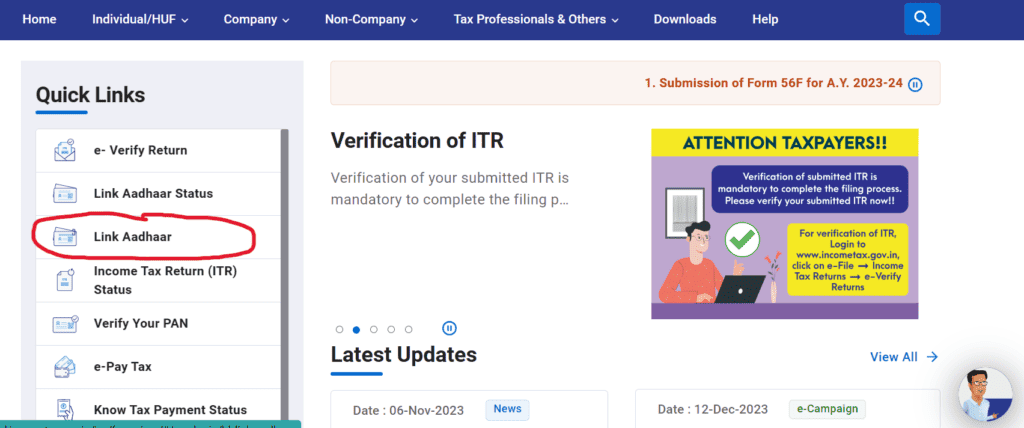

To link the Aadhar to the PAN card, First, open the website incometax.gov.in. On the left side of the page, there is an item in the menu bar “Link Aadhar“

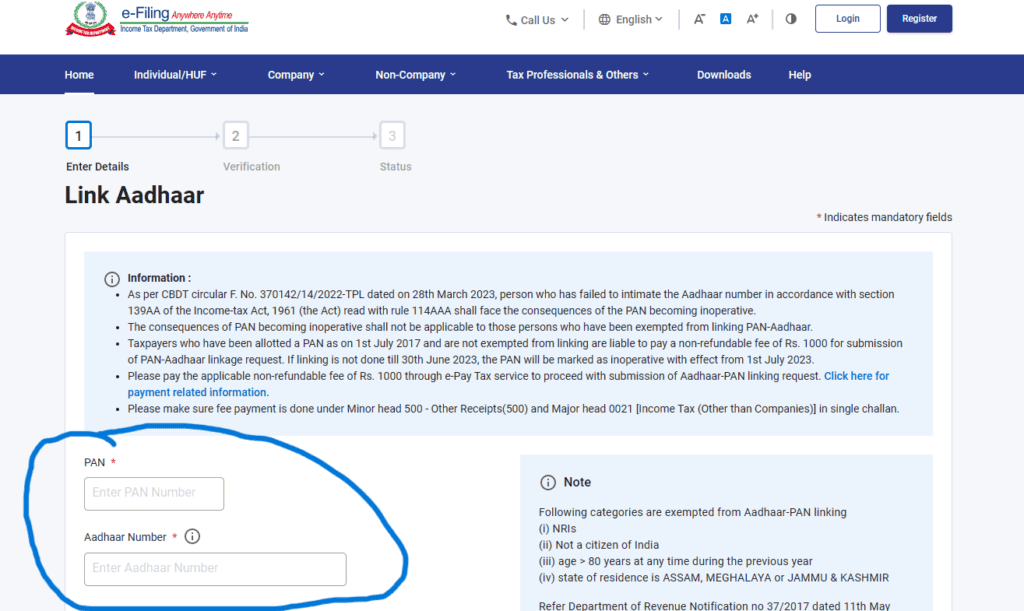

When you click on it, It further opens up to the page where it asks for your Aadhar Card number and PAN Card number. After filling in the details, you have to click on the Blue color Button Validate on the lower right side of the page.

If it is already linked, it pop up the message- “Your PAN CMXXXXXXXX is already linked to given Aadhar 12XXXXXXXX34 “.Otherwise, it just sends the OTP to the connected number to link your Aadhar card with your PAN card and sends the confirmation that it is done.

The Economic Times published a report on December 11, 2023, that “11.5 crore PAN cards deactivated after missing PAN-Aadhaar linking deadline”